Adp withholding calculator

Our free salary paycheck calculator below can help you and your employees estimate their paycheck ahead of time. Important Note on Calculator.

Pin On Payroll Checks

It is perfect for small business especially those new to payroll processing.

. Important Note on Calculator. Ask your employer if they use an automated. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Just enter the wages tax withholdings and. No api key found. Get 3 Months Free Payroll.

To help you get the most accurate. Important Note on Calculator. Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

Use this simple powerful tool whether your. Important Note on Calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

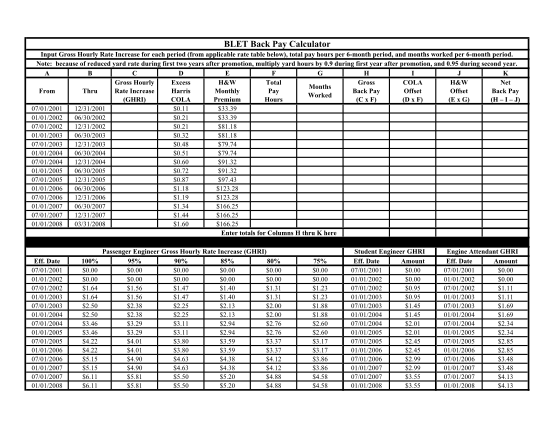

28 2018 the IRS released a revised Form W-4 Employees Withholding Allowance Certificate for 2018 as well as an online. The IRS recommends that taxpayers access the online W-4 Calculator to check their payroll withholding and adjust withholding allowances if needed as early as possible. Multiply the hourly wage by the number of hours worked per week.

Our free paycheck calculator makes it easy for you to calculate pay and withholdings. Get Started With ADP Payroll. Withholding info click Federal.

Then multiply that number by the total number of weeks in a year 52. 3 Review the intro page. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

If you dont see the Edit Withholding button speak with your employer. Ad Calculate Your Payroll With ADP Payroll. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

Adp tax withholding calculatorhorrifying sentence for class 2natural probiotics for pcos. Find copies of current unemployment withholding IRS ADP and other forms using this extensive repository of tax and compliance-related forms and materials. For employees withholding is the amount of federal income tax withheld from your paycheck.

Youre almost done be sure to include federal filing details and extra tax. For instance a paycheck calculator can calculate your. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. New York Paycheck Calculator Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. For example if an employee makes 25 per hour and.

Plug in the amount of money youd like to take home. Woodland scenics green grass. Process Payroll Faster Easier With ADP Payroll.

2 Click Edit Withholding. Get 3 Months Free Payroll. Get Started With ADP Payroll.

The payroll calculator from ADP is easy-to-use and FREE. Process Payroll Faster Easier With ADP Payroll. The amount of income tax your employer withholds from your regular pay.

Ad Calculate Your Payroll With ADP Payroll. To change your tax withholding amount. E92 m3 competition package specs.

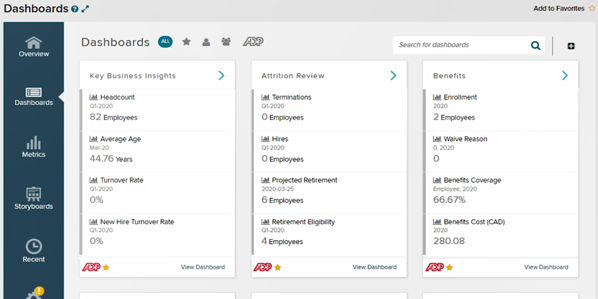

Adp Workforce Now Data Insights Reporting Adp Canada

2

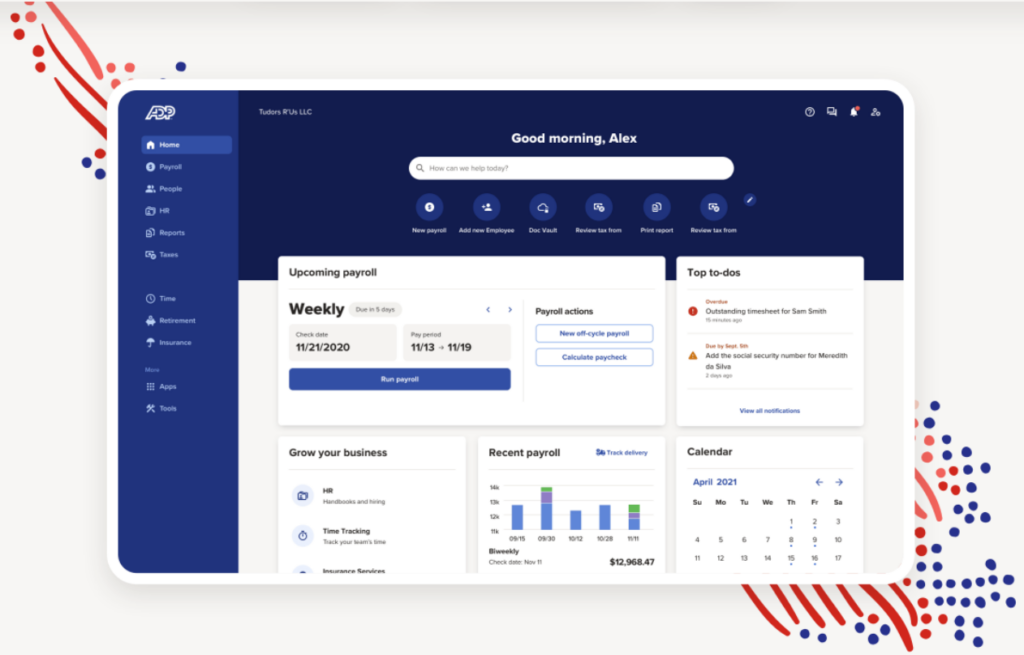

Adp Payroll Best Payroll Services Online For Small Businesses For 2021 Ips Inter Press Service Business

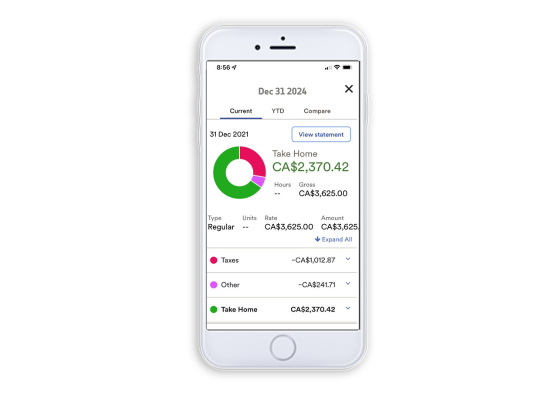

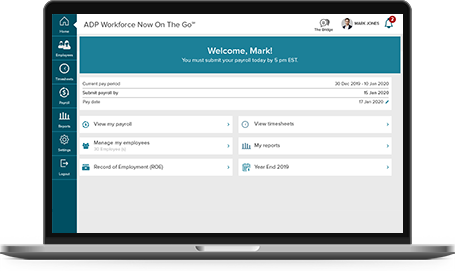

Adp Mobile Solutions Free Mobile App Adp Canada

Seo Title Adp Payroll Review The Pros And Cons

Adp Vs Paychex Comparison 2022

Adp Payroll Review Should You Use It

2

Adp Integration With Prebuilt Connectors From Modulus Data

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Payroll Software For Business Adp Canada

Adp Workforce Now On The Go Payroll Time Tracking Software Adp Canada

Pclaw And Adp Payroll

84 Paycheck Calculator Adp Page 2 Free To Edit Download Print Cocodoc

Adp Workforce Now On The Go Payroll Time Tracking Software Adp Canada

2